Standardizing MAT collection with KAP

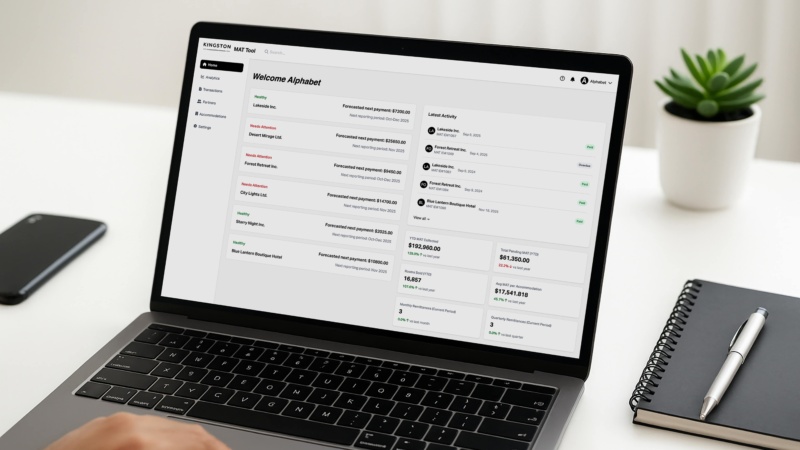

Kingston Accommodation Partners (KAP) needed a better way to collect and report the Municipal Accommodation Tax (MAT). Something easy that worked for accommodation providers and municipal administrators alike. We worked closely with their team to design a custom digital tool that simplifies the process, saves time, and can scale across markets.

Client

Kingston Accommodation Partners

Sector

Tourism

research & discovery

The ins and outs of MAT

MAT is a key source of funding for tourism development, contributing to events, experiences, even infrastructure improvements. But compliance and collection is complicated. Our research uncovered issues with data consistency, time-consuming admin, and poor access to payment and reporting cycles. And no existing tool met KAP’s needs.

Inconsistent process

There wasn’t a standardized way for accommodation providers to track and submit MAT, while existing tools can’t handle multi-market use or future growth.

Barriers for small providers

For B&Bs, short-term rentals, and other small operators, the process was confusing and difficult to comply with, putting strain on local partnerships.

Manual overload

Administrators spent hours reconciling incomplete submissions, filling out spreadsheets manually, and tracking down missing information, taking time from higher-value work.

solution

A simple solution for

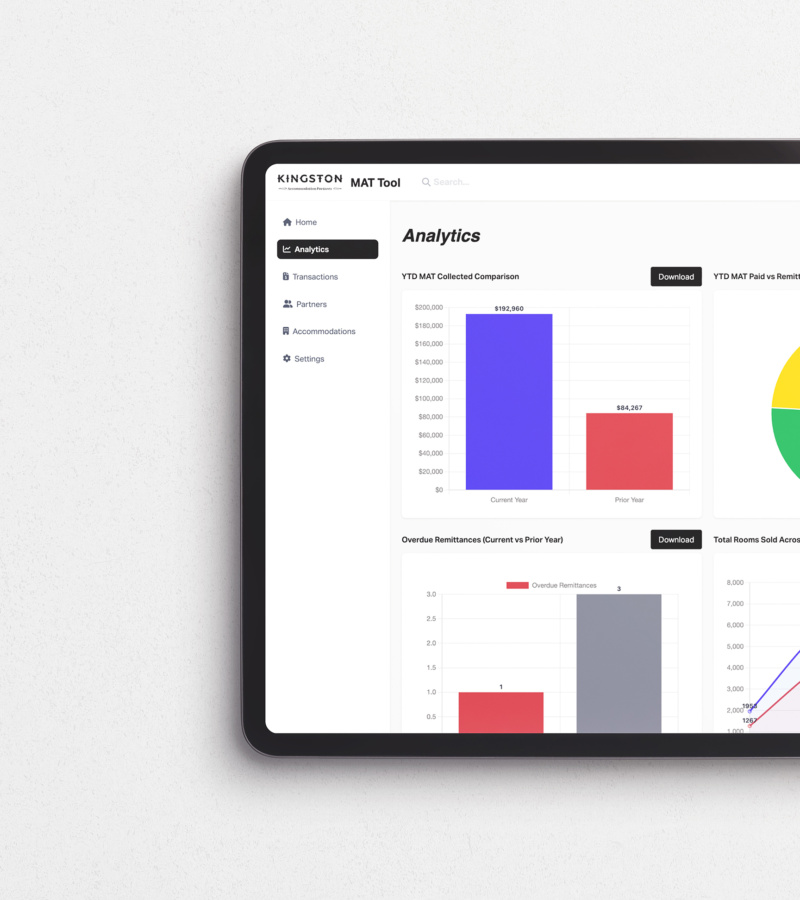

providers and municipalities

With usability and scalability in mind, we built an online tool that streamlines MAT reporting, tracks payments, and makes reconciliation simple. The tool allows providers to log in and submit directly, while municipalities can pull automated reports, issue receipts, and manage records in one secure, user-friendly platform.

tool

Tailored to the industry

We built a custom web app with distinct admin and accommodation provider portals to match KAP’s unique operational needs within the industry.

Smart and secure

The tool automates receipts and reporting, handles data securely, offers real-time tracking, and eliminates hours of manual admin work.

Simple by design

With a clean, mobile-friendly UX, the interface was built to be easy to use, especially for small business owners with limited time or tech experience.

Built to scale

The tool supports multi-market functionality, creating a clear path for licensing in new jurisdictions, new clients, and long-term growth.

productize

On the horizon for tourism and hospitality

The MAT Tool not only improves compliance and cuts admin time, but it also positions KAP as a national leader in MAT reporting. And we built the tool to be licensed and adapted by other municipalities and operators by leading end-to-end development—from research and strategy to UX and UI, from first test to ongoing support.